Time waits for no one. Caregiver, read to make informed choices among the options for you and your loved one’s care. While inflation numbers appear to have peaked, we face rapidly rising health care costs. What contingency plans have you put in place in the event of an unexpected health outcome?

As a baby boomer, born during the final quarter of the 20-year span from 1946 to 1964, I view myself in two ways—the beneficiary of leading-edge boomers’ wisdom and mopping up the spoils.

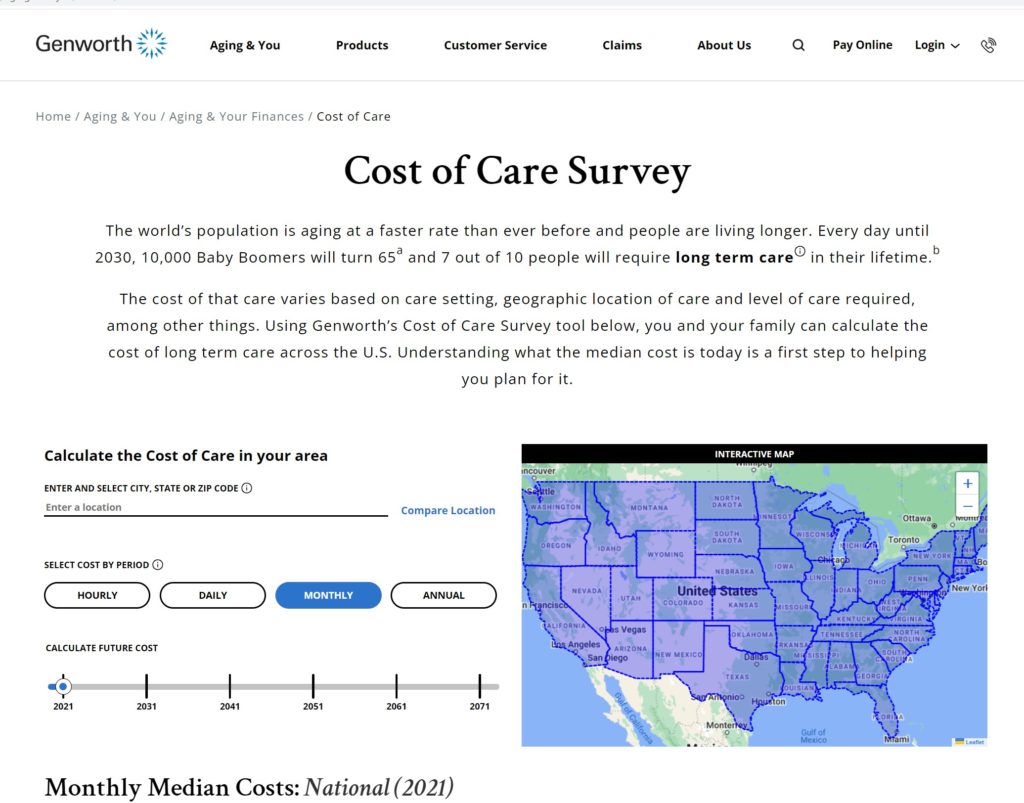

Calculating the Cost of Care with this Tool

Over the years, I have learned that the average time we need skilled nursing care (the most expensive kind) is about three years. Over a decade ago, figures were lower. They moved higher over the past decade with greater care options. Lately, the have declined again; likely due to greater in-home care during the COVID years. Averages being what they are, skilled nursing care may range from one year to five, depending on one’s needs.

In the event you do need care, Genworth offers financial solutions for long-term care and provides an eye-popping interactive tool. Hint: The cost of our future care rises dramatically even at 3% a year.

When you click on the link below, move the toggle for estimates for your care recipient. Remember to consider your own needs, too. Adjust where you believe inflation will be in future years. Right now, we’re hovering between 4 and 5%. Recently, we were between 6 and 7% in the US. That adds up fast. The Federal Reserve’s goal is to return to the 2 range, likely 2.5. How long that will take is uncertain. I used 3%, which almost doubled the cost of care in 20 years.

Genworth’s Interactive 50-Year Cost-of-Care Tool

Our Financial Future—Reality

Many of us will retire without pensions. For the fortunate ones with a pension, does your pension rise with the cost of living? Social Security does, however many other benefits do not. The average retirement SS benefit as of March 2023 is $1,833. Many rely solely on social security during retirement. Others rely on interest and income from retirement accounts; such as an IRA, 401K, or Roth. And a lucky few have squirreled away funds in savings accounts.

To Pay or Not to Pay for Long-Term Care Insurance

Should you pay for long-term care? It depends on your unique circumstances. Do you have enough to pay the premiums until you will need them? More details are provided at Investopedia’s How Much Is Long-Term Care Insurance?

While the optimal age to start making payments is around 60, you may be paying about $325 a month for 20 years, or $3,900 annually. If the premiums don’t rise and you continue paying, you may find a four-fold return on your investment. It depends on various factors. Is there a limit to the life-time coverage amount? Does coverage begin only in the event of a certain illness? Read the information at the Investopedia link above to learn more than you might otherwise think to ask. This also assumes the company you choose to underwrite your insurance is not “too big to fail” and is around when you need to collect.

Please know since your situation will be unique, you’ll be able to make an informed decision after digesting each of the resources linked here.

Final Thoughts

As a late-stage Boomer, I see leading-edge Boomers creating different living options. Villages. Community living. Multi-generational arrangements with elders and college students. Nursing homes need not be one’s primary care option.

Long-term care facilities are catering more toward the wealthy due to the higher profit margin and clients’ desire for luxury amenities. Continuing care retirement communities (CCRCs) cater to those with enough resources to purchase a home in the CCRC and pay a monthly fee. Members of the middle class with limited funds may seek other options such as living with extended family. Many may be stuck in the middle for benefits —that is, they are too rich to qualify for subsidized care and too poor to pay for quality care. With limited options and a spirit of adventure, some are moving out of the U.S. to stretch their dollars and find quality care.

On a personal note, today, I am a single sixty-something female with no children. While I have not (yet) purchased long-term care insurance, a surprise health occurrence could derail me and my ability to pay or even qualify. However, I am optimistic that the right option will be available to me when I need it. Until then, I figure I have another 15 to 20 good years remaining. Life is ever-changing. We’ll see what the future holds.

Thirteen years ago, I wrote, Do I need Long Term Care Insurance? while I was still married. Generally, I still agree.

Additional Resources regarding Long Term Care—

The number of years people may use long term care in/out of their home

How to Choose a Long-Term Care Option That’s Right for You

Northwestern Mutual Life—How Long Does the Average Person Need Long-Term Care?

Pingback: A Care Revolution: Inside Canada’s First Dementia Village